irs tax fourth stimulus checks dependents

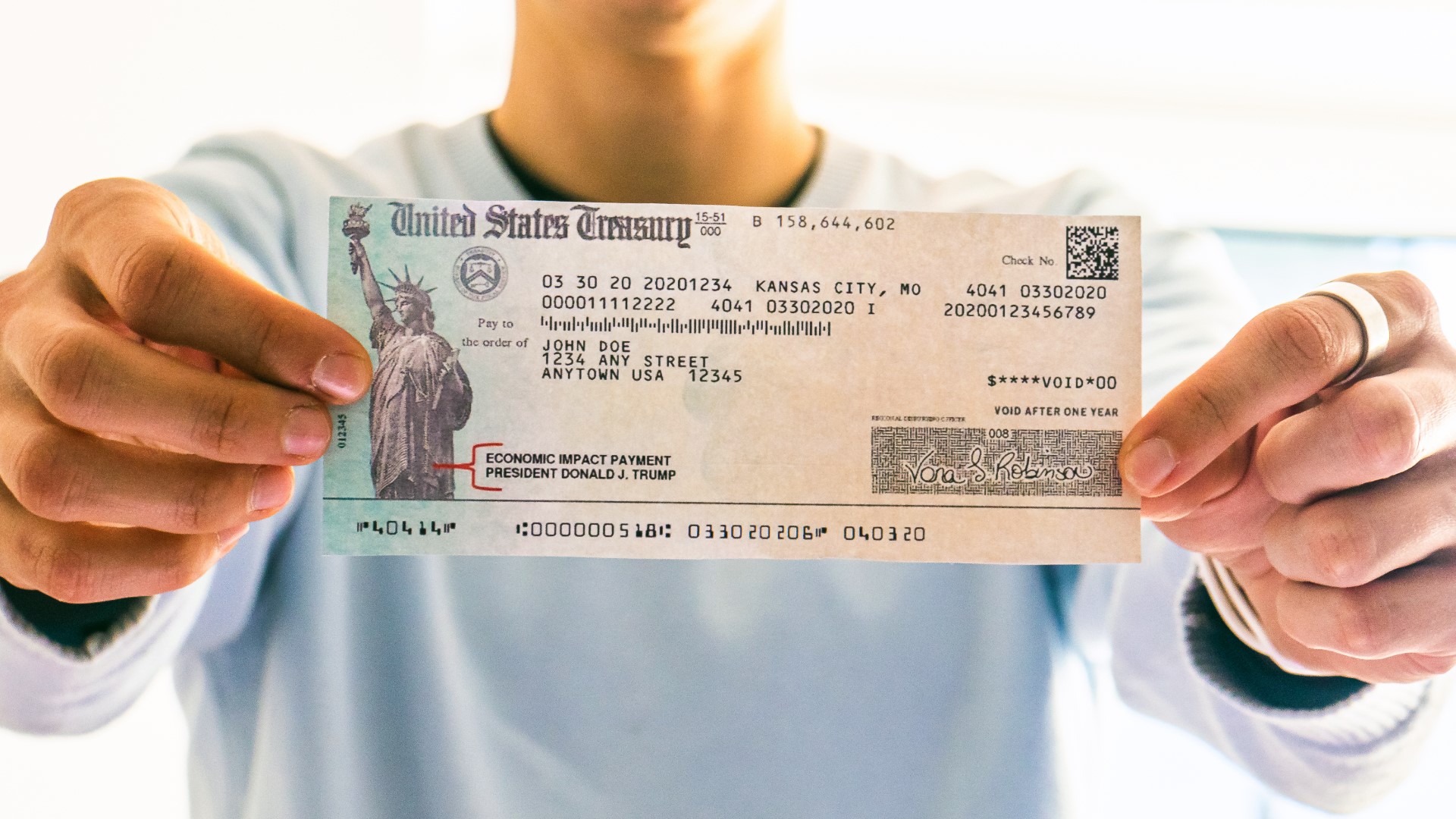

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. The IRS has issued all first second and third Economic Impact Payments.

Where S My Third Stimulus Check Turbotax Tax Tips Videos

The expanded child-tax credit provides up to 3600 per child under age 6 and up to 3000 per child age 6 through 17.

. However while the bureaucratic US government are stopping stimulus checks for the general population there is a progression of projects started on a state level that is set up to attempt to offer some. The 2020 tax returns now offer a section where you can claim the recovery rebate credit for either the first 1200 stimulus check or the second 600 payment if that money is. IRS Tax Fourth Stimulus Checks.

One pandemic-related stimulus that is being considered for an extension is the monthly advance child tax credit. Who is Eligible for IRS Tax Fourth Stimulus Checks As part of the American Rescue Plan Act the new measures set for the fourth stimulus check includes about 1400 US dollars of payments to be issued to individualsparents and their children. As the IRS sends out the last of the third round of stimulus checks and tops off payments for millions of other Americans some lawmakers are already pushing for a fourth check.

Many states are addressing rising inflation with tax rebates and stimulus checks. With two dependents the check would rise to 5600 with three dependents 7000 and so on. The IRS is expected to start sending out payments for the new Child Tax Credit from 15 July providing monthly payments worth up to 300 for children younger than six and 250 for those aged.

If the income is above that threshold. The third stimulus payments worth up to 1400 per individual and each of his or her dependents currently being delivered by the IRS will help many families. Unlike the previous stimulus checks this time the governments focus is parents who have dependents born in 2021.

It raised the previous tax credit from 2000 at tax time to 3000-3600 with the. The Biden Administration Hasnt Promoted Any Additional Stimulus Check Legislation. In December 2020 and January 2021 the cost was 660.

Make less than 150000 a year will receive 350 per taxpayer and another 350 if they have any dependents. 1400 in March 2021. Residents whose income fell under 100000 in 2021 or 200000 for joint filers will receive a 300 tax rebate.

In March 2022 the Biden administration requested 225 billion from Congress to help support the nations. Residents earning more than 100000 or 200000 for joint filers will receive a one-time 100 check. As a result the IRS is now processing via their latest payment batch additional or plus-up extra stimulus payments for tax filers who had earlier received payments based on their 2019 tax return information but are now eligible for a new or.

Typically this means a single person with no dependents received 1400 while married filers with two dependents received 5600. Dependents also are eligible. Unlike the first two payments the third payment was not restricted to children under 17.

Joint filersmarried couples with a combined adjusted gross income of less than 150000 will be entitled to claim the full child tax credit amount of 3600 for children under six and 3000 for. This is because the dependent born in 2021 had not yet been reported to the IRS. The first round of payments as part of the reformed Child Tax Credit is set to go out on the 15 July with monthly payments worth up to 300 per child continuing for the remainder of 2021.

Households who are eligible for the tax credit must have an adjusted gross income of up to 125000. Residents earning more than 100000 or. The IRS is aware that several people have updated taxable income AGI and dependent information in their 2020 tax filings.

The amounts of the three Economic Impact Payments IRS made to eligible people were. The dependent must claimed on this years tax returns. The IRS tax fourth stimulus checks are under consideration and will be payments made by state governments to their residents.

These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. Most families received 1400 per person including all dependents claimed on their tax return. People who are missing stimulus payments should review the information on the Recovery Rebate Credit page to determine their eligibility to claim the credit for tax year 2020 or 2021.

In April 2020 the amount was 1200. Coronavirus has hit Americans hard the nation over however some more than others especially monetarily. COVID-19 Stimulus Checks for Individuals.

Most eligible people already received their Economic Impact Payments. 1200 in April 2020. Dependents are also eligible for the rebate.

IRS Tax Fourth Stimulus Checks Live Updates. The most common group that will see another stimulus check in 2022 are new parents parents with new foster children and parents who recently adopted a child in 2021. Thats 300 per month and 250 per month respectively.

The third check stimulus income limit for your 2020 tax year and you already used your 2019 tax. 600 in December 2020January 2021.

Fourth Stimulus Check Latest What S Behind The Push For Recurring Payments Cbs News

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

How To Get A Stimulus Check If You Don T Have An Address Bank Account

Fourth Stimulus Checks For Seniors Why One Group Says Payments Are Vital

Stimulus Update Will A Fourth Stimulus Check For 2 500 Arrive On July 30 Silive Com

Fourth Stimulus Check What S The Status Weareiowa Com

Even Without Fourth Stimulus Check Millions Of Americans To Receive More Money This Summer

6 Trillion Stimulus Here S Who Got Relief Money So Far

Fourth Stimulus Check Latest What S Behind The Push For Recurring Payments Cbs News

Another 2 2 Million Additional Stimulus Checks Have Gone Out

Is A Fourth Stimulus Check Arriving In 2022 Al Com

Third Stimulus Check Calculator How Much Will Your Stimulus Check Be Forbes Advisor

New Mexico Tax Rebate 2022 How To Claim The New 500 Checks Marca

Fourth Stimulus Checks The Push For Future Rounds Continues But Here Are Some Ways You May Receive Payments Pennlive Com

Fourth Stimulus Check Democrats Call For Recurring Payments King5 Com

Will There Be A Fourth Stimulus Check Here S The Case Against It

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Fourth Stimulus Check Are More Payments Coming Tom S Guide

There S No Chance We Ll Get A 4th Stimulus Check In 2021 Here S What You Get Instead Bgr